Discover the most effective Cheyenne Credit Unions: Trusted and Trustworthy Financial Providers

Discover the most effective Cheyenne Credit Unions: Trusted and Trustworthy Financial Providers

Blog Article

Open the Conveniences of a Federal Cooperative Credit Union Today

Explore the untapped advantages of lining up with a federal credit history union, a tactical economic step that can transform your financial experience. From exclusive member advantages to a strong neighborhood values, federal lending institution offer a distinctive technique to economic services that is both customer-centric and economically valuable. Discover just how this alternate financial design can supply you with an unique perspective on financial wellness and lasting security.

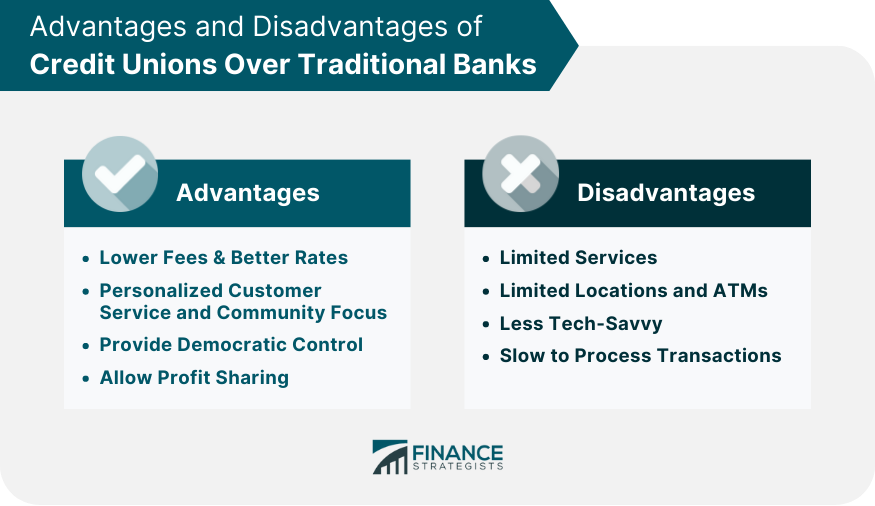

Benefits of Signing Up With a Federal Lending Institution

One of the main advantages of joining a Federal Debt Union is the emphasis on participant contentment rather than producing revenues for investors. In Addition, Federal Credit rating Unions are not-for-profit companies, allowing them to offer affordable rate of interest rates on cost savings accounts, lendings, and credit history cards (Wyoming Federal Credit Union).

One more benefit of signing up with a Federal Credit score Union is the feeling of area and belonging that participants frequently experience. Federal Credit Unions often offer monetary education and resources to aid participants improve their monetary proficiency and make educated decisions regarding their money.

Lower Fees and Affordable Rates

In addition, federal lending institution are known for supplying affordable rate of interest on interest-bearing accounts, fundings, and charge card (Credit Unions Cheyenne). This indicates that members can gain more on their cost savings and pay less rate of interest on fundings contrasted to what standard financial institutions might use. By supplying these competitive prices, government credit rating unions prioritize the financial health of their participants and strive to help them accomplish their financial goals. In general, the reduced fees and competitive prices offered by federal lending institution make them a compelling selection for people looking to optimize their financial advantages.

Individualized Client Service

A hallmark of government lending institution is their devotion to supplying customized customer service customized to the private requirements and preferences of their participants. Unlike conventional banks, government credit rating unions prioritize building strong partnerships with their participants, aiming to supply an extra tailored experience. This personalized approach indicates that participants are not simply viewed as an account number, yet rather as valued individuals with unique financial goals and conditions.

One method government cooperative credit union deliver tailored customer care is with their member-focused strategy. Reps make the effort to understand each participant's particular monetary situation and deal personalized options to satisfy their demands. Whether a member is looking to open up a brand-new account, recommended you read look for a financing, or look for financial suggestions, government debt unions strive to provide tailored assistance and assistance every step of the way.

Community-Focused Initiatives

To even more boost their impact and connection with members, government lending institution actively take part in community-focused initiatives that add to the health and advancement of the areas they serve. These campaigns typically include economic education programs targeted at empowering people with the knowledge and skills to make enlightened decisions concerning their finances (Cheyenne Federal Credit Union). By offering workshops, seminars, and individually therapy sessions, cooperative credit union aid community participants improve their monetary proficiency, handle financial debt efficiently, and strategy for a secure future

Additionally, government credit history unions frequently get involved in local events, sponsor community jobs, and support philanthropic causes to deal with specific requirements within their solution locations. This involvement not only demonstrates their dedication to social duty however also enhances their partnerships with members and cultivates a sense of belonging within the community.

With these community-focused initiatives, federal cooperative credit union play an important role in promoting economic incorporation, financial security, and general prosperity in the regions they operate, inevitably producing a favorable effect that extends past their conventional financial solutions.

Maximizing Your Membership Advantages

When looking to take advantage of your subscription advantages at a lending institution, understanding the array of solutions and resources offered can substantially improve your financial wellness. Federal credit score unions provide a series of benefits to their members, including competitive rate of interest on cost savings accounts and finances, reduced fees contrasted to traditional banks, and customized customer support. By making the most of these advantages, members can enhance their monetary security and accomplish their objectives much more properly.

In addition, participating in economic education programs and workshops given by the website here credit history union can assist you improve your cash administration abilities and make more enlightened decisions about your monetary future. By actively involving with the resources offered to you as a participant, you can unlock the complete possibility of your partnership with the credit rating union.

Verdict

Finally, the benefits of signing up with a federal cooperative credit union consist of lower charges, competitive prices, individualized customer support, and community-focused efforts. By maximizing your membership benefits, you can access expense savings, tailored solutions, and a sense of belonging. Consider opening the benefits of a government lending institution today to experience a banks that prioritizes participant contentment and supplies a range of sources for financial education and learning.

Additionally, Federal Credit scores Unions are not-for-profit Read More Here organizations, allowing them to use affordable interest rates on financial savings accounts, loans, and credit scores cards.

Federal Credit Unions typically provide economic education and sources to assist participants boost their financial literacy and make notified decisions concerning their cash.

Report this page